Want to learn how to print W2 Forms in QuickBooks Desktop? Well, then you have entered to the right place. In this piece of article, we will guide you in every way that you need to know about W2 Forms and how to print W2 Forms in QuickBooks Desktop and that too in very basic steps. Here we go:

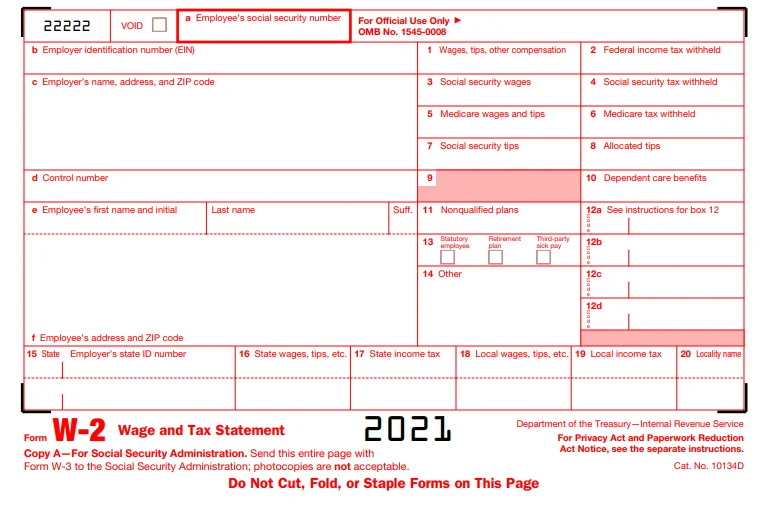

Basically, W-2 Forms are nothing but the statements that contain the information related to salaries or the wages paid by an employer to his employee. In addition to this, it also reveals all the information about the tax deduction from employee’s paychecks which is important for the employee while preparing for its tax returns.

However, Printing W-2 forms is quite critical task for any trading firm as it requires everything about employee’s statement of taxes, social security, report of wages paid along with Medicare taxes etc.

Therefore, before proceeding through the printing process of W2 Forms in QuickBooks Desktop, it is important for you to know some more about W2 Forms, its importance and its printing requirements.

Read Also: How to Print a Pay Stubs or Paychecks in QuickBooks Desktop?

What do you understand by W 2 Form in QuickBooks?

As we are well versed with the fact that in every nation the citizen who is earning well income has to pay income tax every year. And all this tax amount (beneficial) Collected by the Government from its citizens is then used for the developments of its state and the country. So, in every firm employer deducted certain amount from its employee’s salary and files taxes every month for them without even letting them know. Although this entire withdrawal amount is then paid to the IRS (Internal Revenue Service) by the end of each month. Therefore, an employer has to give a detailed account of the amount being deducted as a tax from the salary of the employee. This is only the source from where the W2 form comes in.

W2 Form is a document that gives you detailed information about the amount deducted from an employee’s account on an annual basis. It is also known as the Wage and Tax Statement Form that assists you to calculate the exact amount when you are calculating the return at the end of the year. And W2 employee is the employee is that individual whose taxes are deducted from its salary/wages by his employer to file taxes and submits additional information to the Government.

This W2 Form is sent on or before 31st January every year so that one gets enough time for filing the income taxes before the deadline mostly within the first week of the month of April. This tax is filed by the employer is for the previous year, e.g., you will get the W2 form in January 2021 for the income earned in 2021.

3 Things you should always keep in mind before and after printing W 2 Forms in QuickBooks

Save the draft for the W-2 form

For saving the draft click on the Save as PDF option in the Payroll Tax Form window. This Save As button is shown on the bottom left side of the screen. Once done with this select the location to save your W2 forms as a draft which is then done by clicking the Save button.

While e-filing or printing in QuickBooks Desktop it automatically archives W-2 forms in QuickBooks

In the window of Payroll Tax Form, it automatically creates an archive when e-file or print box is selected. This option is located on the bottom left side of the Payroll Tax form window. It saves the W2 form automatically in the default location and in the PDF format.

Process to access the archived forms when there is no active subscription of payroll tax form window

- You can also access your archived W-2 forms in case your active subscription plan has expired or you have not purchased it yet.

- For this, search the archived W-2 forms in the system for the folder having archived data without opening the QuickBooks program.

- The location of the files is C:UsersPublicDocumentsIntuitQuickBooksSample Company FileQuickBooks XXXX(Write Company name) Tax Form History.

- Now you have to select the folder in the location that has your archived form which is required. It is the same folder whose name includes 941, W2 with its name.

Pre-Requisites to print W 2 Forms in QuickBooks Desktop

A few of the basic necessities that you must arrange in advance for printing the employees W2 form in QuickBooks Desktop are stated below. They are:

- Kindly have the updated or supported version of QuickBooks Desktop installed in your system. Also ensure that this version of QB is compatible with your Windows OS of your system.

- Next thing required to print W2 form is the Black ink to print it on the paper.

- Active QuickBooks Payroll standard service is also required.

- Make sure that you have latest tax table of payroll on your system.

- It is also suggested to have W2 paper for your printer and the payroll service.

- We also recommend to make use of perforated paper/blank papers or pre-printed laser printed forms either.

- Lastly, it is advised that for the ink jet printers you can also use pre-printed forms.

Now you can go ahead for the process of printing W2 forms in QuickBooks Desktop.

3 Basic steps to print W2 Forms in QuickBooks Desktop

Once you are done with all printing requirements, let’s start the process of printing the form with these basic steps. They are as follows:

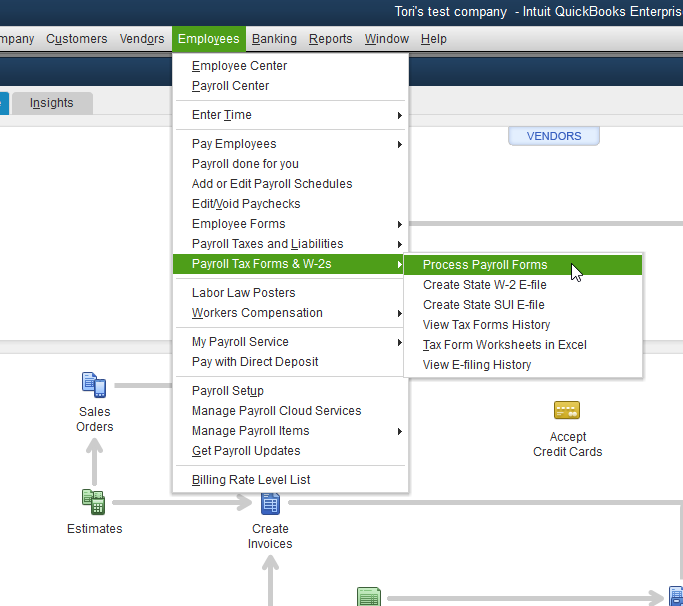

STEP I: Opening the W-2 form from QuickBooks Desktop

- In the beginning, go to the Employees menu and then choose payroll tax forms and W2s

- Further click on the payroll forms process

- Now choose the tax statement transmittal and annual Form W2/W3 wage

- Then hit the “Create form” button for creating it.

- Suppose you need to file the forms of all your employees then for this select All Employees option.

- Along with that, click on the last name of the employee

- Now you have to add/Introduce the year of the form you are printing and then hit the OK button. Only one version of your tax form is saved for QuickBooks Desktop.

For instance: If the QuickBooks 2017 version of your form is already available, but you need to print W2 forms for 2016, you will require a newer version of the form to use it.

- Next you have to select the employees for printing the form. For this, click on review/edit if you haven’t reviewed all your W2 forms.

- For continuing the printing process, you are advised to click on the submission form. Also, to print the type, select the workers. Again, if your W2 forms have not been reviewed, click on review/edit option.

- Finally, Click on the print/e-file button.

You can also check: How to Solve QuickBooks Bank Reconciliation?

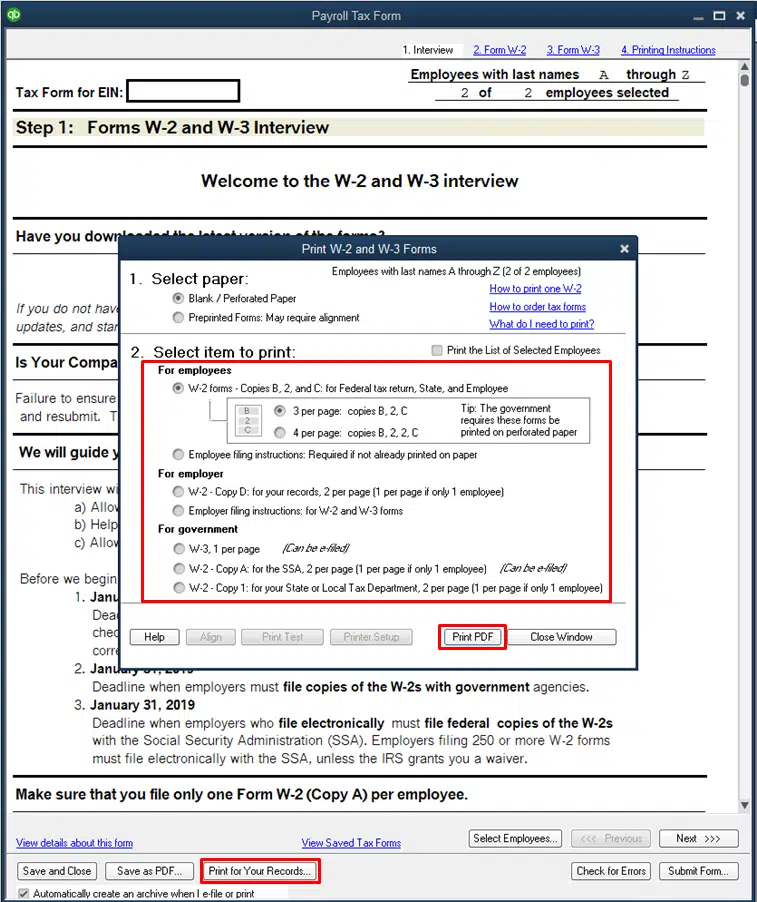

Step II: Pick the paper type and item as well to print in the W-2 and W-3 forms window

- At the very first, select the options for the paper like preprinted forms, blank/perforated paper

- Now under the section of the select item to print, you have to select for whom you want to print

For Employer

- W-2 – Copy D: for your records, 2/page.

- Instructions for employer filing: for a W-2 as well as a W-3 form.

For Employees

If you’re using perforated/blank paper

- 4/page: copies B, 2, 2, C

- 3/page: copies B, 2, C

- Instructions for Employee filing: Needed if not printed on paper already

If you’re using preprinted forms

- Copy 2 of W-2: for your State or Local Tax Department, 2/page.

- W-2 – Copy B: for the annual tax return of an employee, 2/page.

- W-2 – Copy C: records for an employee, 2/page.

- Instructions for Employee filing: Required if not already printed on paper.

For Government

- W-2 – Copy A: for the SSA, 2/page.

- W-3/page.

- W-2 – Copy 1: for the Department of State or Local Tax, 2/page.

Read Also: How to make a Journal Entry in QuickBooks Desktop?

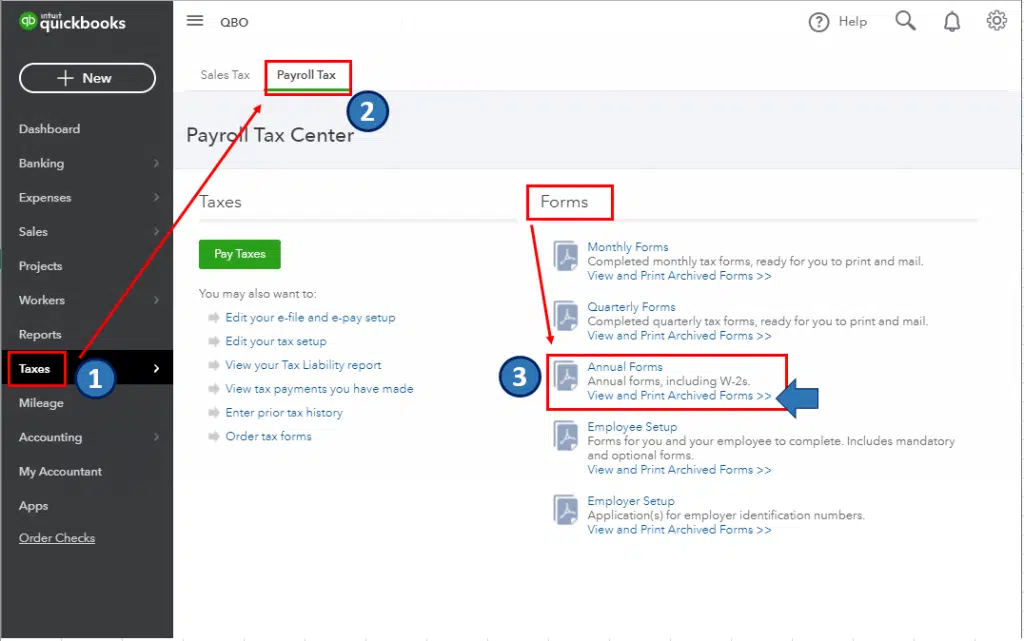

Step III: Export the print W2 Forms in QuickBooks and start printing in your PDF Reader

- You are required to do a printing test if you are using preprinted forms.

- Now, you need to print your PDF by clicking print on it.

- Lastly, start from inside the PDF Reader with the printing process and then you are done with the process.

Also Check Out: Resolve the Balance Sheet Out Of Balance In Accrual Basis

Winding-Up

We are hoping that you find this article helpful for printing W2 forms in QuickBooks Desktop. Additionally, you got the opportunity to learn every detail about W2 forms through this article. But if you are not very good at following instructions and then you could be stuck between.

Therefore, if you encounter any kind of trouble related to this W 2 forms printing process, we would recommend you to take technical assistance from our QuickBooks technical support team by just dialing our toll-free helpline number +1-844-499-6700 Our team of QB experts is available round the clock to provide you immediate support.

Other Helpful Articles

How to Fix QuickBooks Error Message: Connection Has Been Lost?

How to Resolve QuickBooks Error 179?