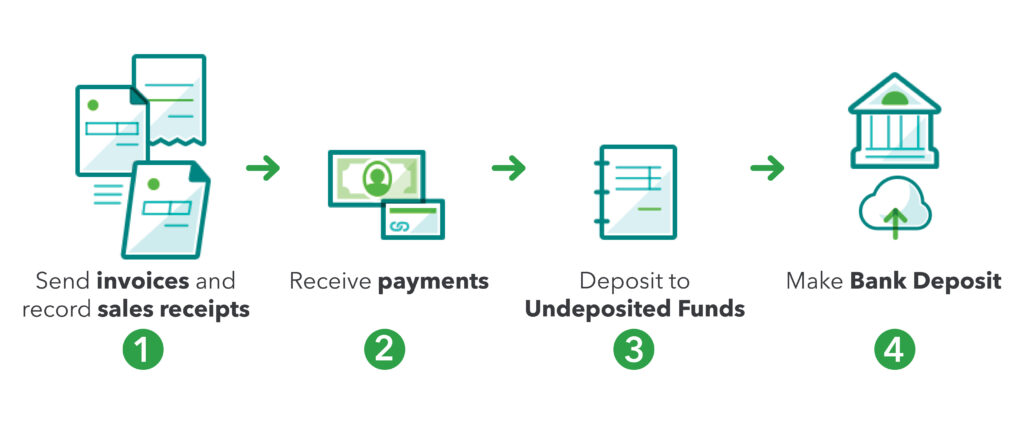

Do you know what an undeposited funds account is and how to combine multiple payments together in QuickBooks? Well, if not, then this segment is something you need to go through. When you put money in the bank, you might deposit several payments at once. Let’s say that you deposit five $100 checks from different customers into a real-life checking account. The bank records all five checks as one US $500 deposit. Thus, you need to combine your five separate US $100 records in QuickBooks, in order to tally what the bank shows as one deposit. However, if you are downloading transactions directly from the bank, then the need to do this is eliminated.

To help you understand Undeposited funds in QuickBooks, here we are with this segment sharing the complete info. For more details, read this segment carefully. You can also contact our technical support team at +1-866-453-7060, and we will provide you with answers to all your queries immediately.

You might find this helpful: How to Delete a Journal Entry in QuickBooks?

How Undeposited Funds in QuickBooks Work?

One can use the undeposited funds account to hold invoice payments and sales receipts that are to be combined. It is similar to a lockbox or drawer where you keep your payments before taking them to the bank. When you have your deposit slip, you need to make a bank deposit in QuickBooks, to combine payments in undeposited funds to tally. This process, ascertains that QuickBooks always matches the bank records. Furthermore, it ensures that your reconciliation process becomes much easier.

Also Read: How to Record Vendor Refunds in QuickBooks Desktop?

Steps for Clearing or Deleting the Undeposited Funds in QuickBooks Desktop

You can successfully clear undeposited funds in Quickbooks using the set of steps enumerated below. Let us have a look:

- You need to simply login QuickBooks and then click on Banking

- Once done with that, select the option to make deposits from the list present.

- After that, locate the payment that you want to deposit within the undeposited account

- Followed by, selecting the payment by heading from the payments tab and selecting make deposits tab.

- Now, click on ok tab.

- Also, you might now be able to see the deposit window showing up on the screen, where you need to click on the deposit tab and select the preferred bank from the list of the drop down options.

- Now, select the date of deposit and any other relevant information, that you would want to record.

- Moreover, if you want to print a deposit slip for maintaining a physical record of all the deposits, then you would simply have to click on print command and then the slip will be printed.

- The last step is to click on the OK tab and then your funds will get cleared from the undeposited account.

Steps to clear undeposited funds in QuickBooks Online

Clearing or deleting undeposited funds in QuickBooks online can help you in keeping the records better and further ascertains that your financial records are more accurate.

- Here, you need to visit https://quickbooks.intuit.com/ website and further log in to QBO account.

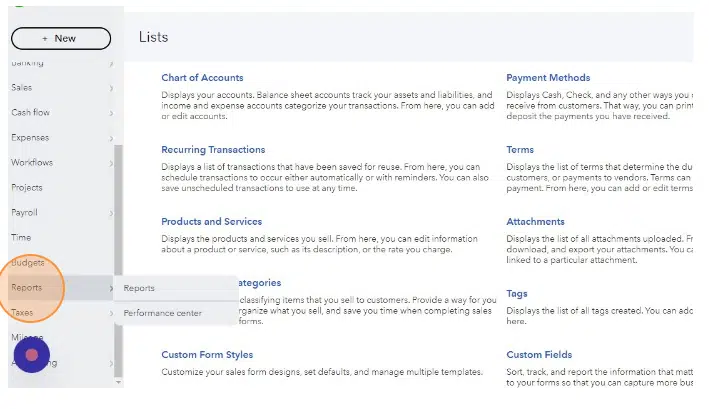

- Now, head to the reports menu.

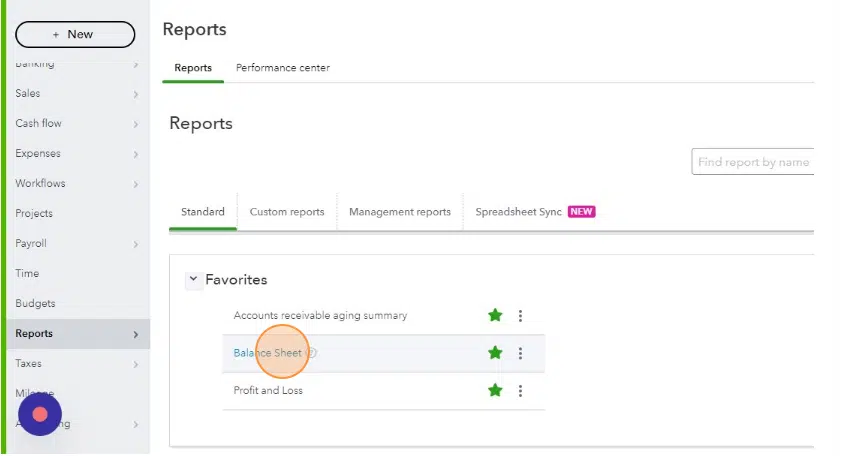

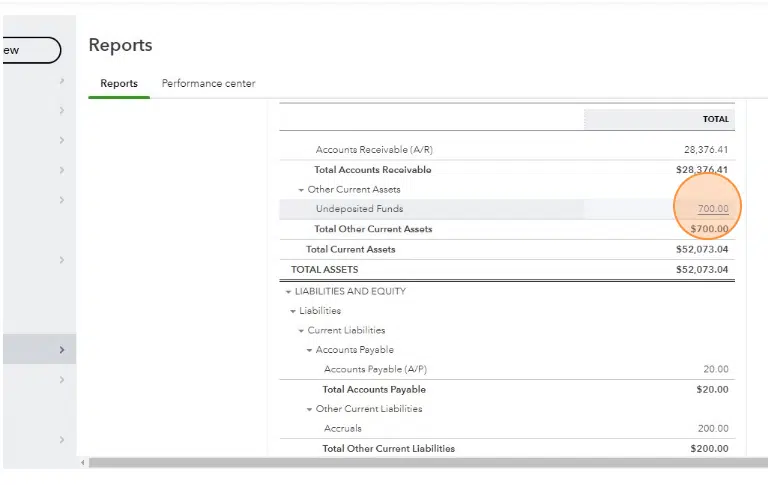

- Now, click on the balance sheet.

Similar Article: Resolve the Balance Sheet Out Of Balance In Accrual Basis

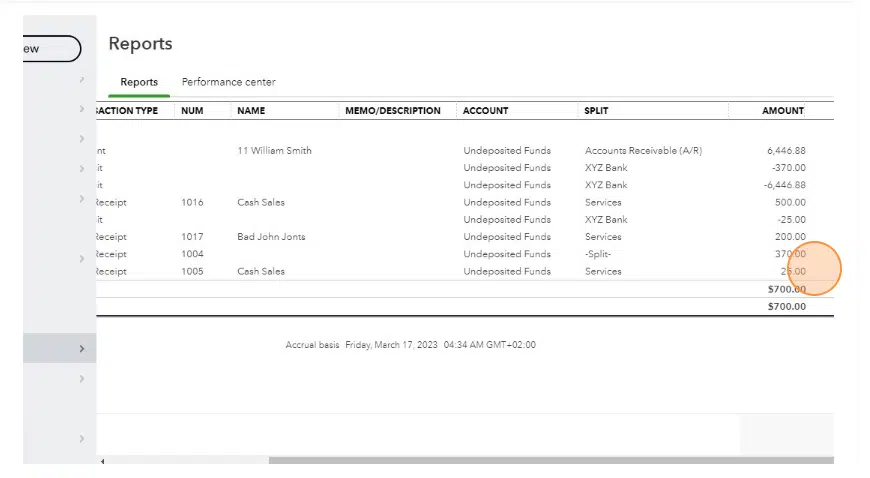

- You now have to click the amount on undeposited funds.

- After that click here.

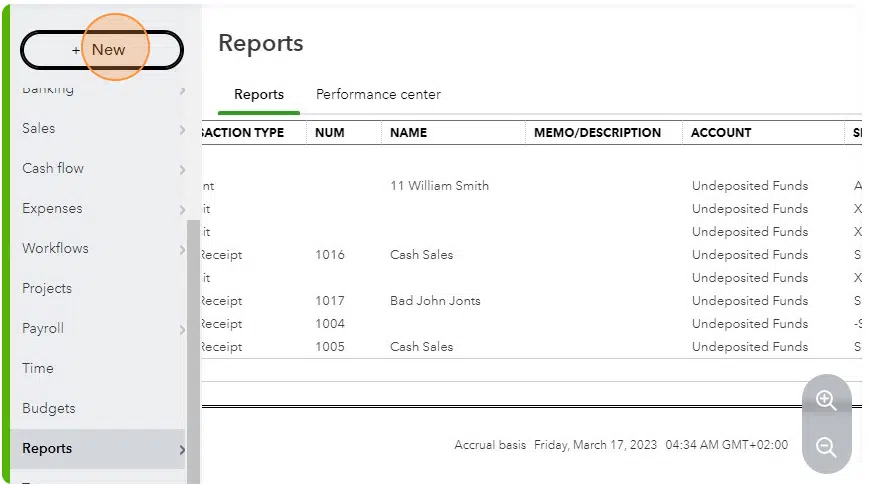

- Now click on + icon or new tab.

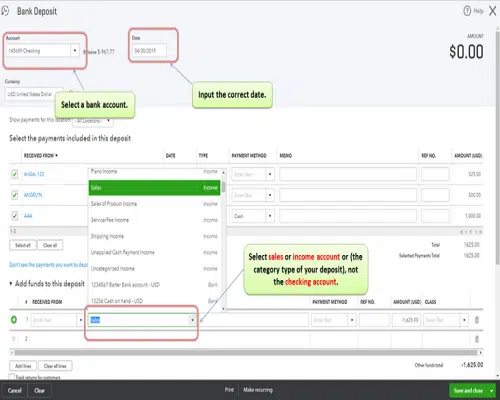

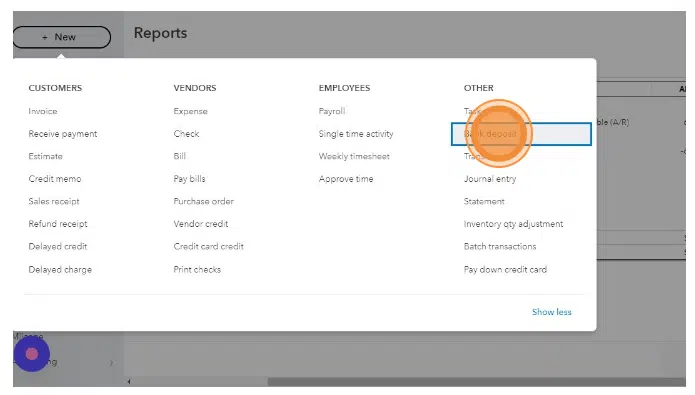

- After that, click on the bank deposit option.

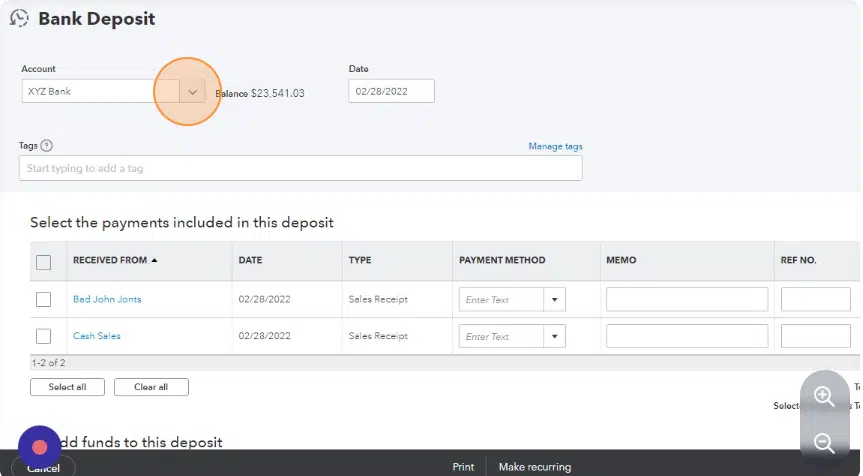

- Select bank account option for the deposits.

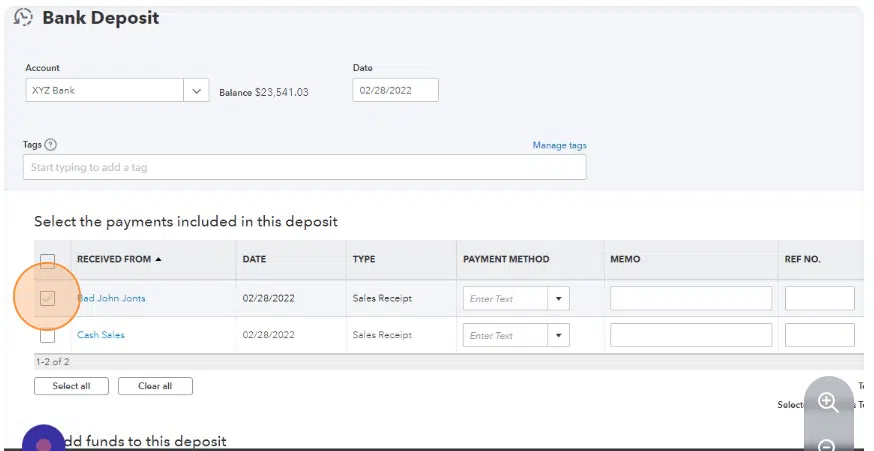

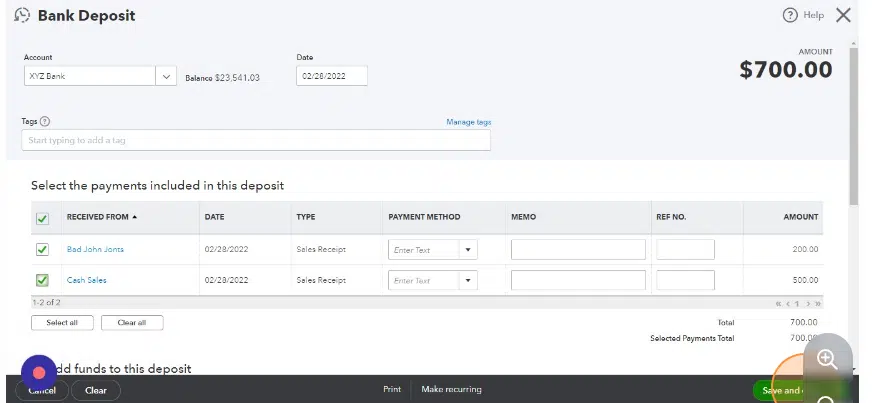

- The next step is to click on the Checkboxes for the deposits.

- The last step is to click on Save and close tabs.

Enter funds in the undeposited account

You can try entering funds in Undeposited accounts, using the steps below:

- The very first step is to launch QuickBooks.

- And later on, click on the list from the menu.

- Also, you need to pick the items tab which will lead you to the drop-down menu.

- After that, select the type of payment you want.

- Now, cater the details required.

- Select the accounts tab.

- Pick the account type as an undeposited account.

- Also, click on ok tab.

- This will create an entry in an undeposited account.

Conclusion!

Coming to the end of this segment, we believe that the reader might be able to understand Undeposited Funds in QuickBooks in a better way. However, if there is any query that is still unanswered, then in that case, contact our technical support team at +1-866-453-7060, and we will provide you with all sorts of technical guidance.

FAQs Related to Undeposited funds Account in QuickBooks

Undeposited funds is simply a holding account that usually tracks payments received from customers that have not been deposited to the bank account. Add image

You can correct the undeposited funds in QuickBooks using the steps below:

1. Click on the +New tab

2. After that, choose Bank deposit

3. From account ▼dropdown, select the account you wish to put the money into.

4. Enter a checkmark on the boxes for each transaction.

5. Further click on save and close.

Well, it can have both debit as well as credit balance. When you get the payment, the balance will be debited to the undeposited fund account, and when you make the deposit entry, the account will be credited with the amount of the deposit in the QuickBooks