For any QuickBooks user who aspires to work on payroll, it is quite essential to at least know how one gets started with QuickBooks payroll. We will now start with Payroll Service Key. You get this 16-digit key when you purchase/buy QuickBooks Payroll. This key is specific to your EIN and payroll service. When you will try to activate payroll service in your QB file, you will have to enter this security key.

Also Read: How to Fix QuickBooks Error Code 1317?

Steps to Enter or Edit Your Payroll Service Key:

Follow the steps given below and you will be able to enter or edit your Payroll Service Key:

Step 1:

- Obtain the service key that you will get in your email.

- In case you have not received your service key, then you can use the automated service key retrieval tool.

- Now, sign in through your Intuit Account and retrieve your service key.

Reasons Behind Not Working of an Automated tool May be:

There are some reasons behind non-working of the automated tool:

- There may be multiple payroll orders in the system for your company

- If the payroll product has been purchased from a retail store

- If the phone number of your business that you have provided does not match what Intuit has saved on its file.

Read Also: How to Fix QuickBooks Desktop Installation Errors?

Step 2:

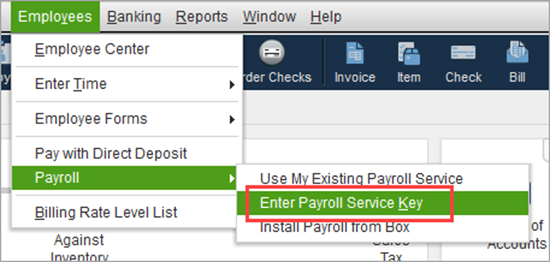

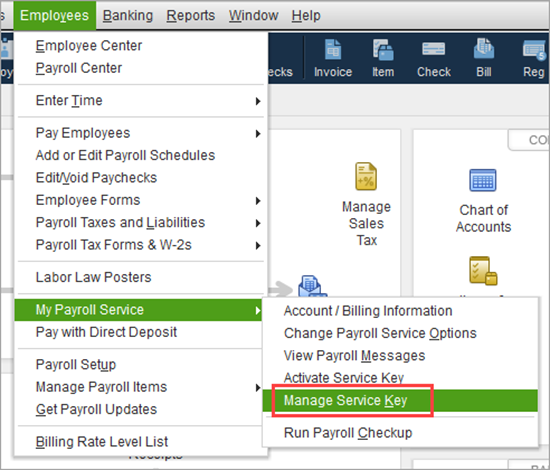

- Open the QuickBooks Service keys window.

- In case there is no payroll service in your company file, then you can choose Employees > Payroll > Enter Payroll Service Key.

- And if you have a payroll service in your company, then choose Employees > My Payroll Services > Manage Payroll Services

Step 3:

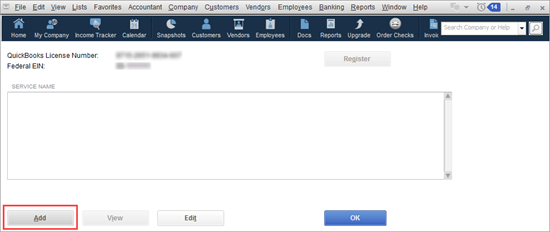

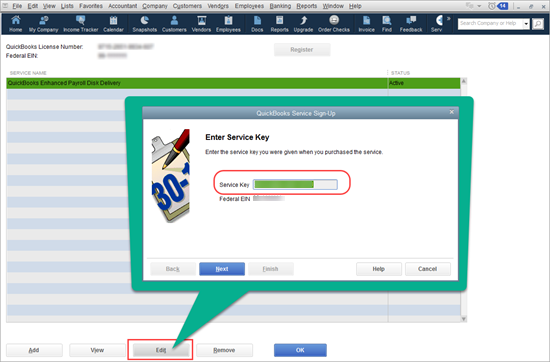

Go to QuickBooks Service Keys window and then Enter your service key

Here’s how:

- Select Add, if no payroll service has been listed.

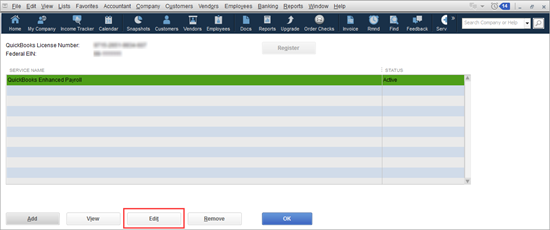

- Choose Edit if payroll service is listed.

- Select Edit again and take note of the service key.

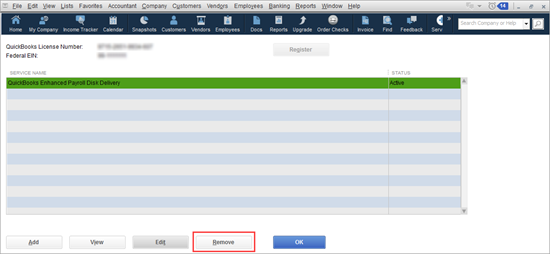

- Go to QuickBooks Desktop and remove the payroll service key.

- Select Next and check if any message of Payroll Update appears.

- If yes, press Ok

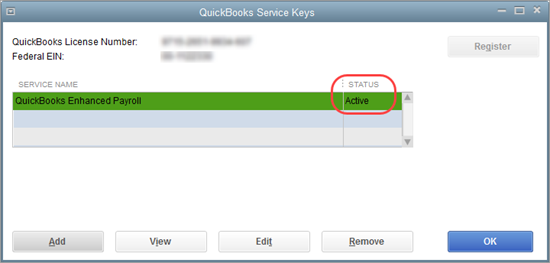

- Finally, Now check and verify the Service Status if it shows ACTIVE.

- If the status is Active then press OK.

You may also like: How to Troubleshoot the QuickBooks Error Code 6069?

Winding Up!

After all these steps, you will able to enter and edit the service key. If you face an issue, you can call on our QuickBooks payroll support toll-free number @ +1-866-453-7060 and get the desired support from our experts.

Suggested Articles:

How To Locate Missing Transactions In QuickBooks Desktop?

How to Fix Reconcile Discrepancies in QuickBooks?

Steps to Fix QuickBooks Error Code OL-332

Some FAQs Related to QuickBooks Payroll

A payroll service is a company that handles the process of paying employees for a business. They typically handle tasks such as calculating employee paychecks, deducting taxes, and distributing payments. Payroll services work by receiving employee data from a business, calculating the necessary deductions, and processing payments to employees.

Using a payroll service can provide many benefits for your business, including saving time and reducing errors in payroll processing. It can also help ensure that payroll taxes are filed correctly and on time, avoiding costly penalties. Additionally, some payroll services offer additional HR services, such as benefits administration and employee onboarding.

Yes, payroll services can be a great option for businesses of any size. Even if you only have a few employees, using a payroll service can help ensure that you are complying with payroll tax laws and that your employees are paid accurately and on time.

To get started with payroll services for your business, you can call our toll-free number at +1-866-453-7060 to speak with one of our representatives. They can help you understand the services we offer and guide you through the process of setting up payroll services for your business.

When choosing a payroll service, it is important to consider factors such as cost, level of service, and additional features such as HR services. It may also be helpful to read reviews from other businesses who have used the service. Finally, it is important to ensure that the payroll service you choose is able to integrate with your existing accounting software and processes.