QuickBooks accounting software is loaded with various features and functionalities, one such feature is that it lets you reconcile your payroll liabilities. When we talk about payroll reconciliation, it is basically the process of comparing your payroll register with the amount you plan to pay your employees. The aim of reconciling in QuickBooks is to confirm that the numbers match. Coming to payroll liabilities in QuickBooks, it can simply be categorized into two basic categories i.e., employer expenses, and employee liability. These two are then classified into sub-categories namely federal income tax, state income tax, social security withholding, and Medicare withholding. It is crucial to reconcile payroll liabilities in QuickBooks. To help you with this process, here we are with this segment sharing the complete information on how you can reconcile payroll liabilities.

For more details, stick around to this piece of writing carefully, or you can further get in touch with our technical support professionals at +1-888-510-9198, and we will provide you with instant support and guidance.

You Should Also Check This: Ways to Undo or Delete Reconciliation in QuickBooks

Essential steps for reconciling payroll liabilities in QuickBooks

You can try performing the steps below, in order to successfully reconcile payroll liabilities. The steps involved in the procedure are as follows:

Step 1: Create liability accounts

- You need to simply start by making a list of the liability accounts.

- The list of payroll liability accounts you need to reconcile includes:

- Federal income tax withholding payable

- Statement income tax withholding payable

- FICA tax payable

- 401K or retirement benefit premiums payable

- Health insurance payable

Step 2: Create transaction labels

- You are now supposed to create transaction labels to separate employee and employer payroll liability transactions.

- Now, you will have to turn on tagging from the settings tab and further click on QuickBooks.

- Now, look for the tags feature and turn it on by clicking on the done tab when receiving the confirmation.

- Further, create a new tag group.

- For which you can head to the settings tab and go for tags.

- Select new and then tag the group.

- You will have to name the new tag group payroll liabilities and click on save.

Step 3: Create payroll liability sheets

- You will have to simply set up payroll liability reconciliation sheets.

Step 4: Printing Reports

- Under this step, you are supposed to print reports from your QuickBooks payroll software and general ledger. You can either print these reports or send them via email, as per your convenience and requirement.

Step 5: Reviewing the transaction

- Herein, you need to review each payroll liability transaction and further reconcile outstanding items.

- This step is essential, as it rechecks any aberrations in the payroll transactions

Step 6: Fix reconciling items

- This is the last and final step, where you are supposed to fix any payroll liability reconciling items, if present.

Also Read: How to Fix QuickBooks Error PS077 or PS032: When Updating or Downloading Payroll?

Steps to Reconcile Payroll Liabilities in QuickBooks Online

You can try performing the steps below to reconcile payroll liabilities in QuickBooks online manually. Let us have a look:

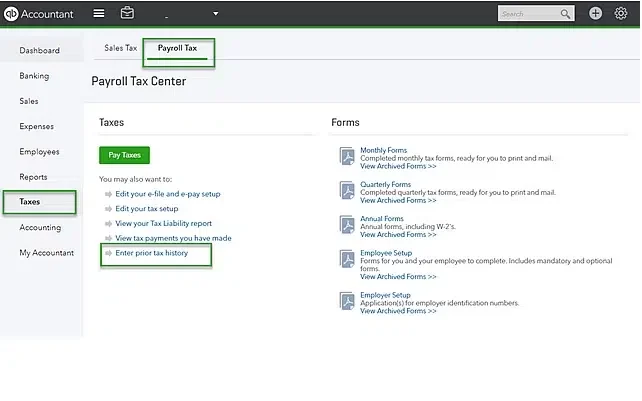

- At first, select taxes in the QuickBooks online navigation bar.

- Once done with that, click on the payroll taxes option, and underpay taxes click on prior tax history.

- Select the current year and liability period

- Click on add payment and select tax type to reconcile tax returns.

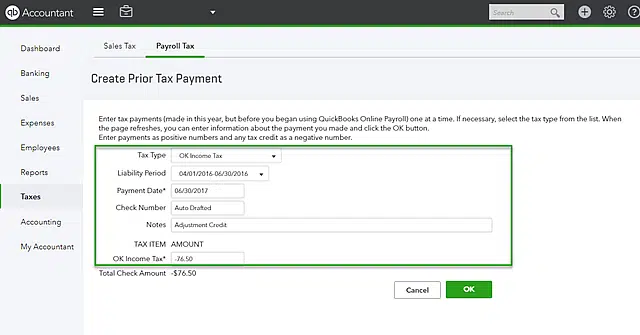

- Now, enter the liability period and period date along with the check number and notes.

- Once done with that, create a credit by creating a negative amount.

- The last step in the process is to click on ok tab and this will reconcile the payroll liabilities successfully.

You might also find this helpful: QuickBooks Payroll Not Taking Out Taxes [Fixed]

Conclusion!

Toward the end of this segment, we hope that the information shared in above might be of some help in reconciling payroll liabilities in QuickBooks. However, in case you have any queries, or if you need any sort of QuickBooks payroll support and guidance, then in that scenario, do not hesitate in connecting with our technical support professionals at +1-888-510-9198, and let them help you with all your QuickBooks-related queries.

FAQs Related to Payroll Liabilities in QuickBooks

You can reconcile a payroll liability accounting using the steps below:

1. Check the payroll register.

2. The payroll register lists all the crucial details about an employee’s payroll during a pay period.

3. Furthermore, confirm the employee time cards.

4. Also, check pay rates.

5. Confirm paycheck deductions.

6. And then, record in the general ledger.

7. Submit payroll.

For adjusting payroll liabilities for the company file, the steps below can help:

1. From the reports menu, choose employees and payroll, then PD7A Report.

2. Now, choose the date range .

3. Furthermore, select the employees, and payroll liabilities.

4. Also, adjust payroll liabilities.

Payroll liabilities in QuickBooks include the wages of employees, payroll taxes, employee education, and service costs.

For this, you need to perform the following steps:

1. Choose employees and also go for payroll center.

2. Furthermore, you need to choose payroll liabilities tab.

3. Also, choose change payment method from other activities drop-down list.

4. Now, in the QuickBooks payroll setup window, choose benefit and also other payments.

Other Related Articles:

How to Fix QuickBooks Payroll Update Error 15243?

QuickBooks Desktop 2024 Download, Pricing, and Features

How to Fix Payroll Setup Error code format 00000 XXXXX [Unrecoverable Error]?