Is your QuickBooks payroll not taking out taxes? Well, a few QuickBooks users have reported this issue quite recently. It isn’t a commonly encountered error and can be experienced due to a handful of reasons. Usually, QuickBooks payroll automatically calculates taxes and if the employee isn’t required to contribute to a specific tax, then you can create an exemption for the same. However, at times due to a few reasons, QuickBooks payroll might not take out taxes.

Thus, to help you in such a scenario, here we are with this piece of writing sharing the complete info related to QuickBooks payroll not taking out taxes issue. Just in case you are seeking any sort of technical assistance, give us a call at +1-888-510-9198, and our certified QuickBooks ProAdvisors will answer all your queries.

Also Read: QuickBooks is Unable to Send Emails [Network Connection Failure]

Causes of QuickBooks payroll is not taking taxes out of payroll error

You can experience QuickBooks payroll not taking out taxes error due to the following reasons:

- In case the gross wages belonging to the employee as per the last payroll are quite low.

- Another possible reason is that the payroll tax tables are outdated.

- You can further come across the same issue if the total annual salary of the employee is more than the salary limit.

Read Also: QuickBooks Tool Hub

Quick Fixes to QuickBooks payroll isn’t calculating payroll tax issue

You can try fixing the issue with QuickBooks payroll using the effective steps below. Note, that the solutions differ according to the condition. Thus, make sure to perform the steps accordingly.

Condition 1: If the year-to-date and quarter-to-date wage or tax information of the employee is incorrect

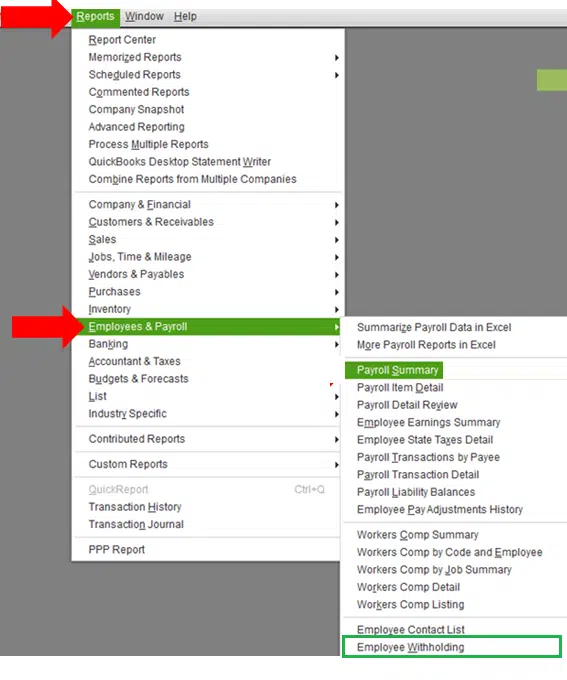

It is possible to view the taxes of all the active employees in an employee withholding report. This can be done using the set of steps below:

- At first, select reports

- After that, move to employees and payroll

- You now have to click on employee withholding

- Further, click on Customise Report tab

- Also, go for columns as per the requirements

- Now, click on the items you want to display on the report in the display list section.

- Once done with that, select ok tab to save changes

- Also, check if your employees are set up accurately for state, local, and federal taxes.

- Now, for editing the employee info window, you need to ensure that you double-click the employee’s name.

- Further, the employee information window will show up.

- Now, click the payroll info.

- Also, tap on the taxes tab.

- The next step is to click on the federal, state, and other tabs.

- Lastly, ensure that the employee is marked properly for taxes.

Read More at: Transfer QuickBooks Desktop to Another Computer

Condition 2: In case you bought a QuickBooks payroll subscription

- You can save the paycheck of the employee depending upon the calculations that were made earlier.

- Now, change the check details of the employee to ensure accurate calculations.

- Further, manually enter both the withholding and employer matches in QuickBooks payroll.

- If in case you have already subscribed to the assisted version of payroll, then you might face issues due to the payroll taxes being filled by Intuit.

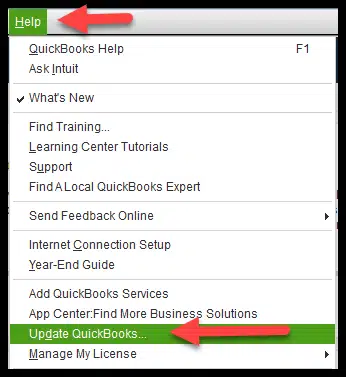

- You will further have to update QuickBooks to the latest release.

- This will sync the software with the latest payroll forms and tax tables.

- Before you run the payroll, check if the employees and payroll items have been set up properly.

- If the data within QuickBooks is not set up, then you might come across this issue for sure.

Condition 3: Check if the annual limit has been set or reached

The annual limit box and default limit may be check marked, which might lead to an issue where the payroll item is not calculating correctly and it stops calculating on a paycheck. In such a scenario, you can verify the setup of the item by:

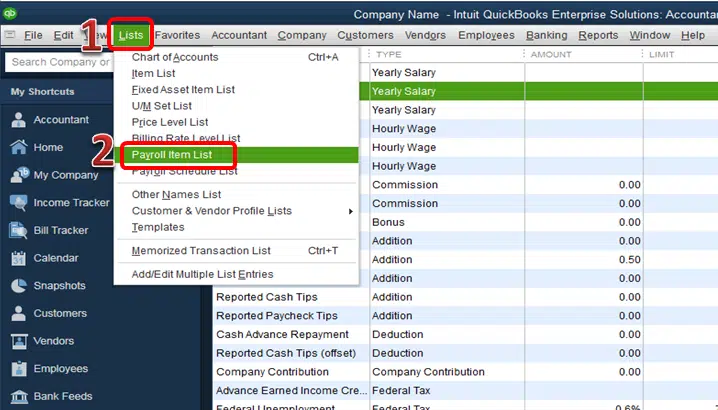

- At first, select lists and payroll item lists from the top menu bar.

- Further, right-click the payroll item that you want to modify and further choose edit payroll items.

- You now have to scroll down to the next screen till you reach the limit type screen.

- Once done with that, verify that the box at the bottom is correct.

- Just in case the limit is correct, the employee’s payroll should stop calculating at that limit.

- Or else you can update the amount.

- Now, under the limit type, verify that you have opted for the right option.

- Annual – Restart every year

- Monthly – Restart every month

- One-time limit

- You can also change the default limit or limit type selection according to the requirements.

- Now, conclude the process by clicking on the finish tab.

You May Also Read: QuickBooks Automated Password Reset Tool

Other Effective steps to correct payroll taxes in QuickBooks

If none of the methods discussed above helped you in fixing the QuickBooks payroll is not taking out taxes, then in that case, try performing the below steps.

Method 1:

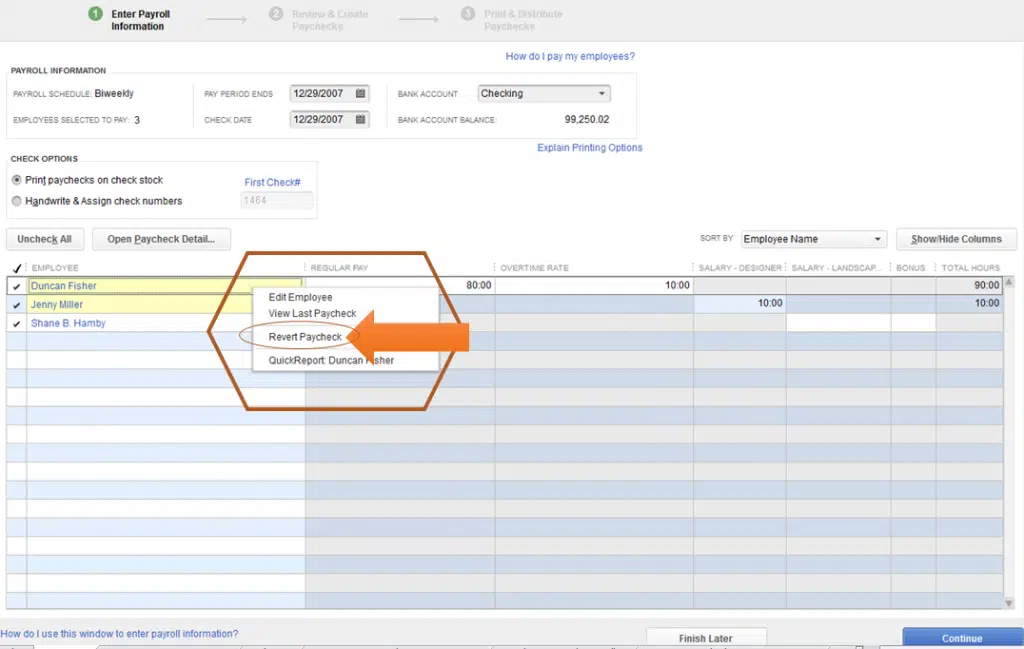

Make sure that the software is in the latest version. Further review the employee’s tax setup, as it affects the process of QuickBooks calculating taxes. After that, revert the employee’s paycheck. This would refresh the payroll info for calculating the taxes on the transaction. For this, you need to carry out the steps below:

- Open the employee’s payroll information.

- Further, right-click the name of the employee which is highlighted in the yellow circle.

- You now have to choose Revert paycheck.

- And this would rectify the issue up to a certain extent.

Method 2:

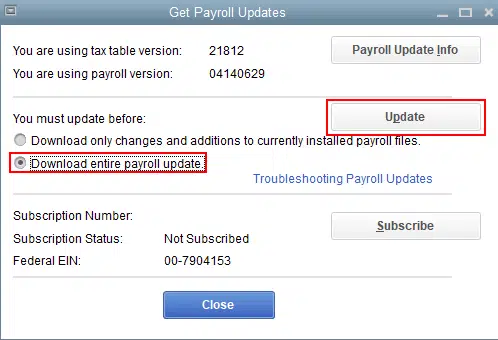

- Under this process, you need to open QuickBooks.

- Now, click on employees.

- And further, choose the get payroll updates option.

- The next step is to choose the download entire payroll update radio-tab.

- And then, select update.

- Wait for the process to complete.

Conclusion!

QuickBooks payroll not taking out taxes is an uncommon error making it even more complicated to tackle. However, once you implement the steps enumerated above, it is believed that you might be able to rectify the issue up to a certain extent. In case you still need any sort of technical guidance at any point in time, or if you are still facing the same issue, then do not think much in connecting with our technical support team at +1-888-510-9198, and we will provide you with immediate solutions to all your QuickBooks related issues.

You May Also Like:

QuickBooks File Doctor Tool – Download, Install & Use

QuickBooks Desktop 2024 Download, Pricing, and Features

How to transfer QuickBooks from Old Computer to a New Computer?