How to learn the process of creating an invoice in QuickBooks desktop and online:

Hunting for ways to create an invoice in QuickBooks desktop? QuickBooks is among the most dependable and composite accounting software in the market that has sprawled a revolution across businesses and accountancy sectors. It is sophisticated and innovative QuickBooks accounting software trusted by hundreds of thousands of business owners and accountants throughout the world.

So, if you are looking for the process of generating invoices in QuickBooks desktop and online follow this blog post till end where everything relevant to this is discussed in detail.

It is available in both desktop and online versions where every year a new version of the application is launched with wide range of new and improved features such as financial management, invoice raising, inventory handling and more. For the felicitous growth of Business firms, it is very essential for the entrepreneurs and managers to maintain the flow of cash in the most suitable way, you might generally look for the process to create invoice in QuickBooks means to manage the receivables of account through invoices. This feature of crafting an invoice can be easily done with the help of QuickBooks Desktop.

What is meant by invoice?

Invoice means ‘promise to pay’, In other words it is an asset and liability for the seller and the buyer. It is also defined as the itemized commercial document that is used for recording the sales transactions between a buyer and seller like paper receipt from a store or online record from an e-trailer

See it also: System requirements for QuickBooks desktop 2022?

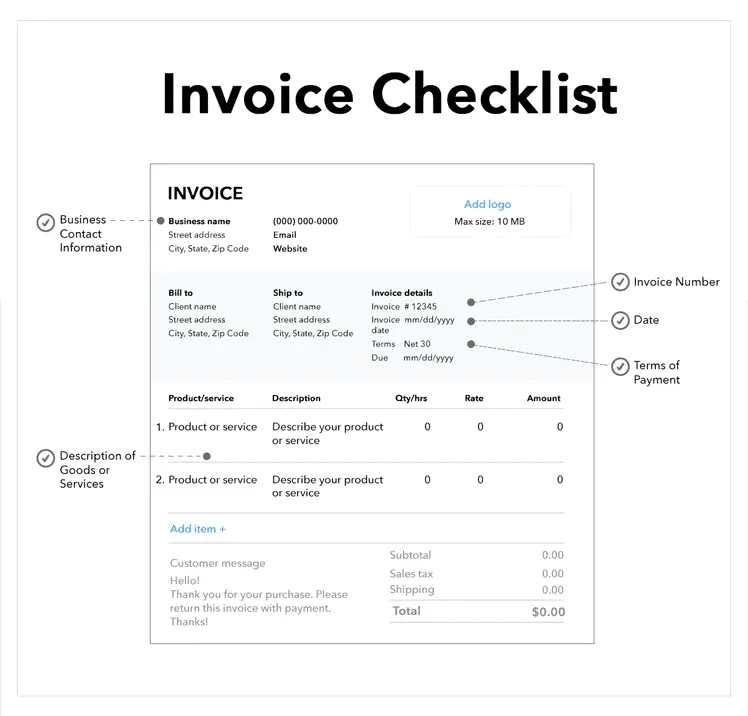

Elements of an Invoice.

- ‘Invoice’ word

- Invoice number.

- Date

- Terms of payment

- Contact number and Name of the seller.

- Contact number and Name of the buyer.

- Description of Goods and services.

- Terms and conditions.

How creating an invoice in QuickBooks Desktop can help you?

Creating an invoice is a part of accounts receivable workflow in QuickBooks.

- It helps in maintaining records of sale.

- It helps in tracking payment on both seller and buyer’s end.

- It acts as a legal proof, which is gives legal safety as well.

- It gathers both Business data and essential data.

- It is helpful in sending email invoices easily to the customers directly from QuickBooks.

- It is helpful in updating financial statements in real time.

How to craft an Invoice in QuickBooks desktop?

Before starting with the process of creating an invoice one important thing that people should take into consideration is to ensure having all the required details for creation.

Basic Steps for generating an invoice from scratch in QuickBooks:

Follow the steps in the same ways that are listed below:

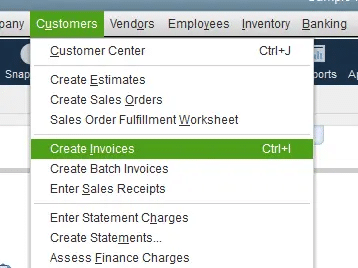

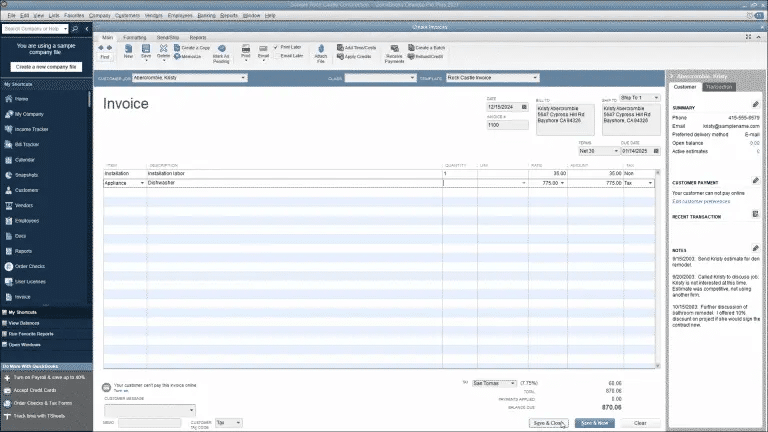

- Select create invoices from the home screen or the customers menu.

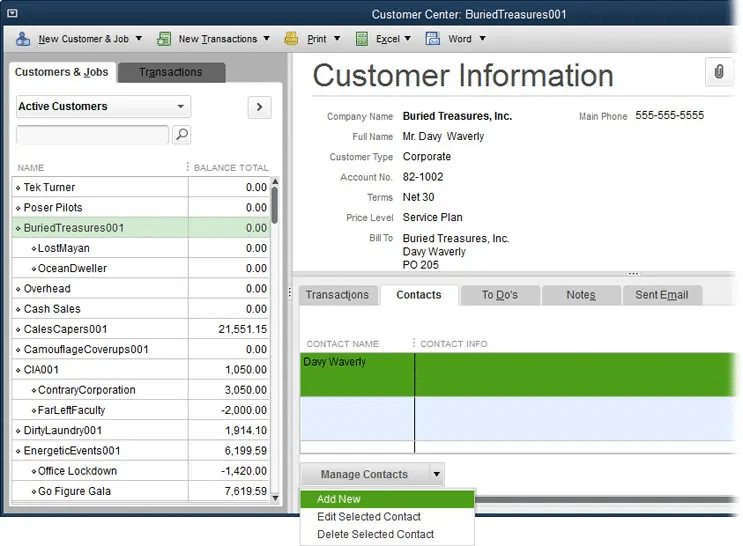

- Select the customer or customer job from the list, In case the customer or job is not on the list yet, then select the add new option.

- Now fill the relevant information at the top of the form such as the Date, invoice number, Bill to/Ship to, P O. number, Rep, Ship, Via, F.O.B and terms.

- Select the items. It should be noted that the when you choose or adds an item, the description and amount are categorized on the basis of description and unit cost entered when it was set up that too on its own. While creating invoices you can also delete or modify this.

See this also: How to Fix QuickBooks Error 6000, 301?

- This step is optional if you wish to apply for a discount, for this you need to create a discount item.

- At first move to the list menu from the home screen.

- Select item list.

- Now right click anywhere, followed by selecting new.

- Go to the type drop down and then select discount.

- Furthermore, you need to enter the item name/number and a brief description.

- Then you need to enter the discount amount or percentage in the Amount or % field.

- In case the discount amount varies, you will have to leave the amount or percent field blank and then enter the amount directly on the sales forms.

- Choose the income account to be used to track discounts from the account drop-down.

- Choose an appropriate tax code for the item.

- Also Tap on OK button.

You may also read: How to Fix QuickBooks Error 3371 Status Code 11118?

To Create an invoice from a sales order:

A sales order is a document or record of a sale generated by the seller promised to deliver to the customer in the future, but haven’t fulfilled yet. Some business firms use this sales order feature of QuickBooks Desktop to track these sales.

Here’s how you create an invoice from sales order

- Select the “Sales Orders” icon from the home screen.

- In the Sales Order form use the “find” button to select the sales order you wish to create an invoice for.

- Now click on the “Create Invoice” icon.

- Next you’ll get a pop-up window asking if you want to create an invoice for all sales orders or just for selected items. Select the option of your choice and then click on the “OK” button.

- If you want to create an invoice for selected items, you’ll see a new pop-up box that allows you to select what you want to invoice now.

- Go to the options that are suitable for you and then click the “OK” button

- This will take you to the invoice screen occupied with the information from the sales order, Here you can edit and send the invoice as described in the previous section.

Read this also: How to Fix QuickBooks Error Code 80029c4a?

To Create an invoice from an estimate:

- If you use estimates in QuickBooks Desktop, you can easily convert them to invoices because some customers require an estimate before agreeing to work with you, or perhaps your internal workflow requires you to enter estimates for jobs you are bidding or have won but not yet invoiced.

- The process of creating an invoice from an estimate is nearly identical to creating an invoice from a sales order, so here is only the three key differences between the two:

- At first start by clicking on the “Estimates” icon on the home screen.

- Here you can only create one invoice per estimate, unlike sales orders where you can invoice for multiple sales orders on one invoice.

- If you are using progress invoicing — a handy feature that allows you to bill projects in phases — you will be prompted to choose how much of the estimate you wish to bill on this particular invoice. This process is very similar to that for choosing sales order items to include on an invoice.

Winding up!

However, if you feel the need of technical assistance or in case of any queries, please feel free to contact our helpline i.e. 1(844)405-0907 where our team of QuickBooks enterprise support and industries best accounting professionals with years of experience and expertise are ready to assist you, let our experts carry out the process for you. Our sole aim is to provide the best possible support services to our clients. So, you can call us anytime without any hesitation, we will be happy to serve you.

Other helpful articles:

How to Fix QuickBooks Error Code 6189?