Form W-3 stands for Transmittal of Wage and Tax Statements. It summarizes W-2 employee information about the total W-2 earnings, FICA wages and tax amount withheld. It further consists of the federal income wages and tax amount withheld. In certain cases, you don’t need to file a W-3 form. Filing form W-3 is based on how your W-2s are filed with the social security administration. But if you are required to file for W-3, then this segment will help you in learning the complete procedure to print w3 form in QuickBooks. Let us explore the complete set of steps in detail.

On the other hand, if you are seeking professional guidance to carry out the procedure to file and print W-3 in QBO or for any related to intuit forms, then do not hesitate in connecting with our technical support team at +1-844-499-6700, and they will provide you with immediate solutions.

What is w3 form?

W3 form is a tax form that is used by the employers to report an employee’s total income to the Social Security Administration and to the Internal Revenue Services (IRS). Employees who get more than one W-2 Form from their employers need to be addressed to the IRS and Social Security Administration about their total salary payments and withholding amounts. This is done by filling W3 form by the employers and sending it to the respective authority.

Here is How to print W 2 Forms in QuickBooks Desktop? – Click to know more!

Steps to Print W3 in QuickBooks Online

As a business, you might need to print various forms in QuickBooks. Below we have stated the steps to print W-3 form in QuickBooks online payroll. Note that in QuickBooks online, printing W-3 forms depends upon how you pay and file the form.

Condition 1: When Intuit pay and file w-3 form for you.

In such a scenario, the form will be emailed to your employees starting January 16-31. In case you need to, you can reprint them on plain paper on January 13. The current year’s or any previous year’s form can be printed from when you started using QBO payroll.

Print the current year or 1-year prior W-3 form

- To begin the process, move to the taxes option in QuickBooks online account.

- Once done with that, click on payroll tax.

- You now have to choose filings.

- Also, opt for print both employer and employee copies of your w-3 form.

- The next step is to choose view on the transmittal wage and tax statements (W-3)

- In case you are printing employee copies, then you will see those who want a paper copy and those who want to opt for paperless.

- A printed copy won’t be provided to the ones chosen paperless.

- You will now have to click on the view tab.

- In case you come across a question asking if you or your employees contributed to a retirement plan outside of QuickBooks online, you will have to select yes or no, and carry out the steps above to get back to the W-3 form.

- The last step is to click on the print tab on the Adobe Reader toolbar.

- And also choose print tab again.

How to Fix QuickBooks Payroll Tax Tables: Download, Install and Verify? – Check This Out!!

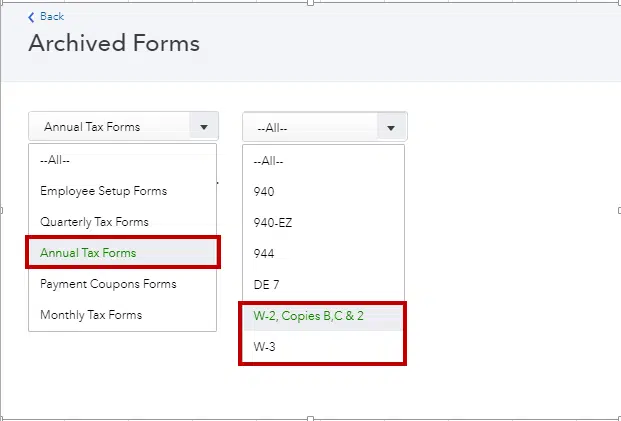

Print Previous Years

- For this, you need to first head to the taxes menu.

- Further click on payroll tax.

- And also choose filings and opt for resources.

- Once done with that, click on Archived forms and filings and also set the date range you need, or search the QuickBooks forms you need.

- The next step is to choose the view on the w-3 form that you want to print.

- Also, click on the print icon on the reader toolbar.

- After that, choose print again.

Condition 2: In case you pay and file electronically or manually

In case you pay and file your W-3 form electronically or manually. You can print the W-3 form starting January 1. And can print the current year or any previous form from when you started using QBO payroll.

Printing the current year or a year prior

For printing the current year or a year prior W-3 form, you need to perform the set of steps below:

- Navigate to the taxes menu.

- Followed by clicking on the payroll tax.

- And further choose filings.

- From there, you can further choose to print both employer and employee copies of W-3.

- Once done with that, choose archive or view on transmittal of wage and tax statement.

- In case you are printing employee copies, you will see the following:

- For W-2 Print setting: 4-part or 3-party perforated paper. Opt for the change setting, in case you need to change your paper type.

- Employees who need a printed W-2 and those who want a paperless W-2. Note that, the employees who need paperless won’t be selected and won’t get a printed copy. You will then have to click on view.

- A question might appear asking if you or your employees contributed to a retirement plan outside of QBO. Choose yes or no accordingly and further perform the steps above to get back to your W-3 form.

- The last step is to choose the print icon on the Adobe Reader toolbar. Also, click on print again.

This is how you can: Change Employee Payroll Information through QuickBooks

Printing previous years W-3 forms in QuickBooks online

- For this, you need to first navigate to the taxes menu and further choose payroll tax.

- After that click on filings.

- And also opt for resources.

- You now have to click on archived forms and filings.

- And further set the date range you need, or search the forms you need.

- Heading forward, click on the view tab on the W-3 form you want to print.

- And choose the print icon on the reader toolbar.

- The last step is to choose print again.

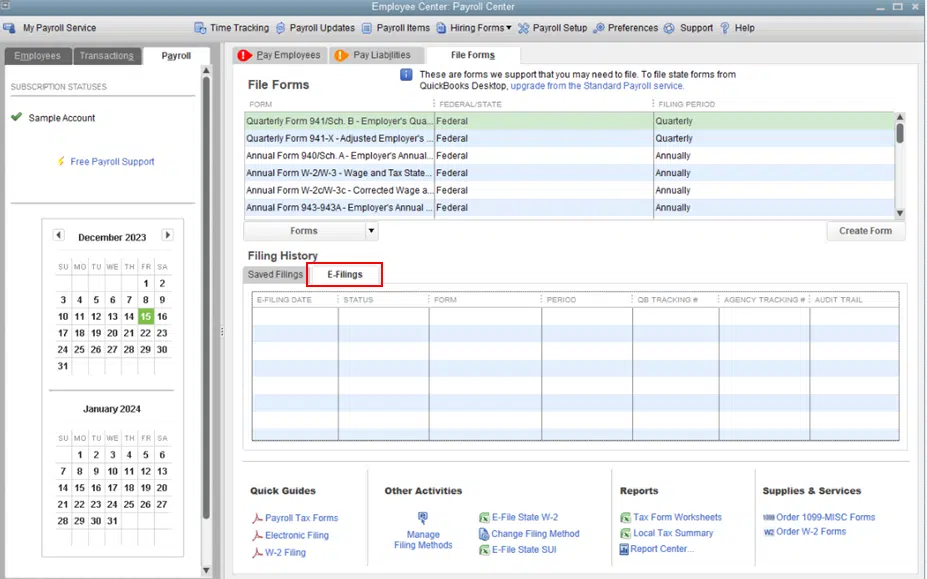

Steps to print W3 in QuickBooks Desktop

For printing W-3 forms in QuickBooks Desktop, you can either choose automatic or manual method. Here is how to print w3 in quickbooks desktop:

Step 1: Print W-3 form if automatic feature is enabled

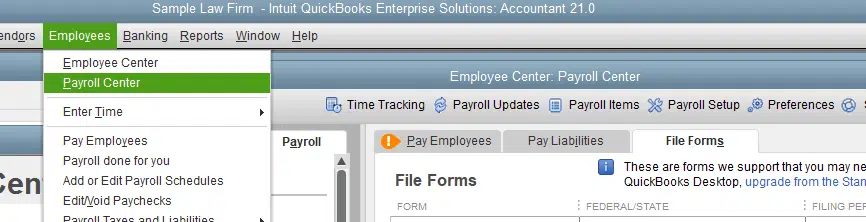

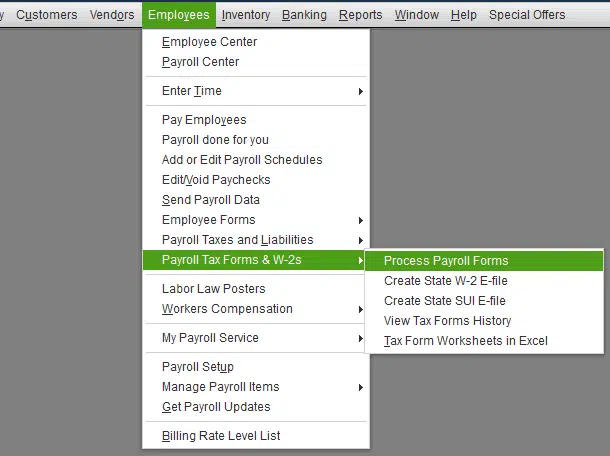

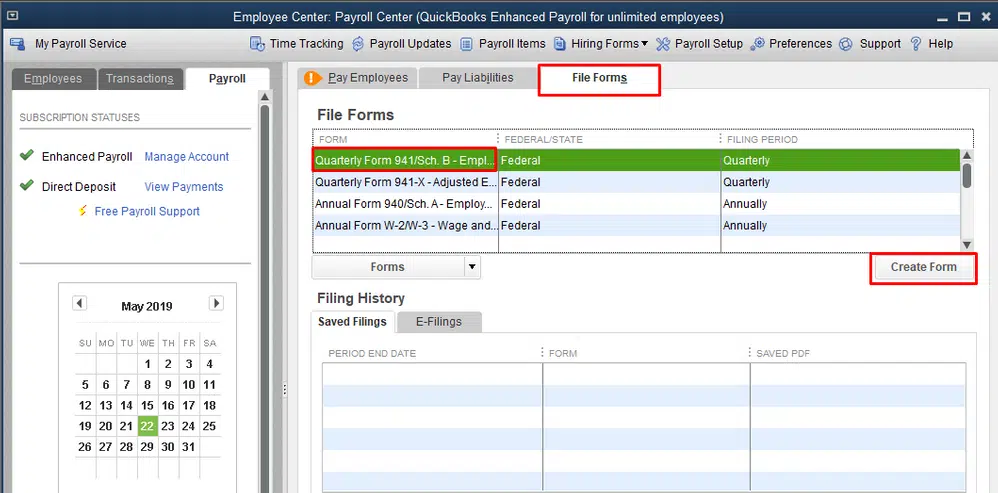

- Under this process, you will first have to click on the employees tab.

- Heading forward, click on payroll center in the employees tab.

- You will now have to visit file forms option.

- And choose the option to view or print W-3 forms.

- The next step is to add the correct PIN for payroll.

- Now click on ok tab.

- Click on W-3.

- And choose the year for which you want to print the form.

- The next step is to click on the option to open/save selected.

- And further click on the option to view the form in Adobe Reader.

- After that, in Adobe Reader, click on the file menu.

- Choose the print option from the file menu.

- And also ensure to type Reissued statement option when reprinting the form.

Have you checked this: How to Turn off Sales Tax in QuickBooks Online

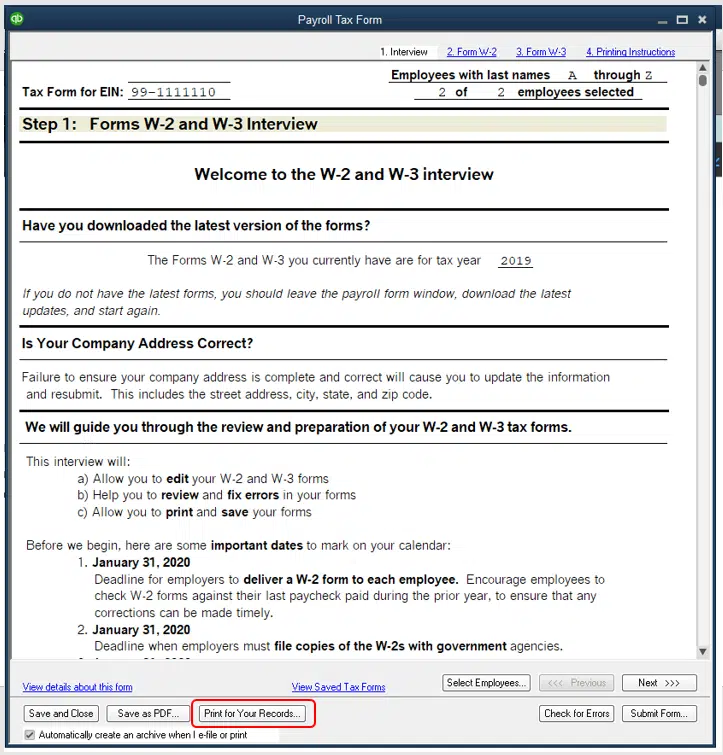

Step 2: Manually print W3 in QuickBooks Desktop

In case you want to file and pay your tax returns manually, then perform the steps below:

- The very first step is to open QuickBooks.

- Now, click on the employees option.

- You will further have to opt for the payroll tax forms and W-2s option.

- Moving ahead, click on the option to process payroll forms.

- Now, click on the file forms option.

- And pick the annual form W-3.

- You now have to click on the option to create form.

- Select employees tab.

- And further include the date.

- Also click on ok tab.

- And select the review option.

- You will see a checkmark beside Reviewed W-2s in the reviewed section.

- The next step is to click on the Submit form option.

- Once you are done with that, click on the view option and use Adobe reader to view the W3 form.

- Towards the end, click on print option by selecting print in the file menu.

- Or you can click on Ctrl + P keys to print the form.

You might relate to this: How to Fix PS033 Error: QuickBooks Can’t Read your Payroll Setup Files?

Conclusion!

Now that you know the steps stating how to print W3 in QuickBooks online and desktop, it is time to implement those steps. However, in case you have any queries or if you get stuck at any step, feel free to ring our QuickBooks support team up at +1-844-499-6700, and they will help you with the procedure smoothly. Our technical team consists of professionals having sound QuickBooks knowledge. Thus, reach out to us in case of any queries related to QuickBooks.

FAQs Related to W-3 forms in QuickBooks

W-3 in QuickBooks payroll is Transmittal wage and tax statements that summarize W-2 employee information about: Total w-2 earnings, etc.

In order to print tax forms in QuickBooks, you can perform the steps below:

1. Move to the employees menu.

2. Choose the payroll center.

3. After that, select the file forms tab.

4. Now, select view/print forms and W-2s

You can print W2 on plain paper by clicking on W-2 printing settings. Under how do you want to print form W-2? you need to click on employee W-2 forms on plain paper. After that click on ok tab and this will print it for you successfully.

You can find W-3 and print it using the steps below:

1. The very first step is to choose taxes.

2. After that, opt for payroll tax.

3. Now, choose filings.

4. You will see your W-2s and W-3 listed, but you can only file them from here.

5. Choose resources, and further click on W-2s or W-3s.

6. Once done with that, perform the steps to print it successfully.

Other Related Articles:

How to Fix QuickBooks Error PS077 or PS032: When Updating or Downloading Payroll?

How to Fix QuickBooks Error Code 15270?