Invoicing is an essential part of running a business. Creating an invoice in QuickBooks, issuing it to customers promptly, and paying invoices from suppliers on time ensures that the cash flows into the business regularly and helps maintain good relationships with the supply chain. One such invoice is a Proforma invoice. It is a type of document that can be accessed as proof of purchase and sales. In this segment, we are going to discuss what is a proforma invoice, along with the complete set of steps that you can carry out to create a proforma invoice in QuickBooks. Thus, stick around this segment carefully, or you can also consult our technical support team at +1-866-453-7060, and we will provide you with immediate support services.

Also Read: Create an invoice in QuickBooks Online

What is a Proforma Invoice in QuickBooks?

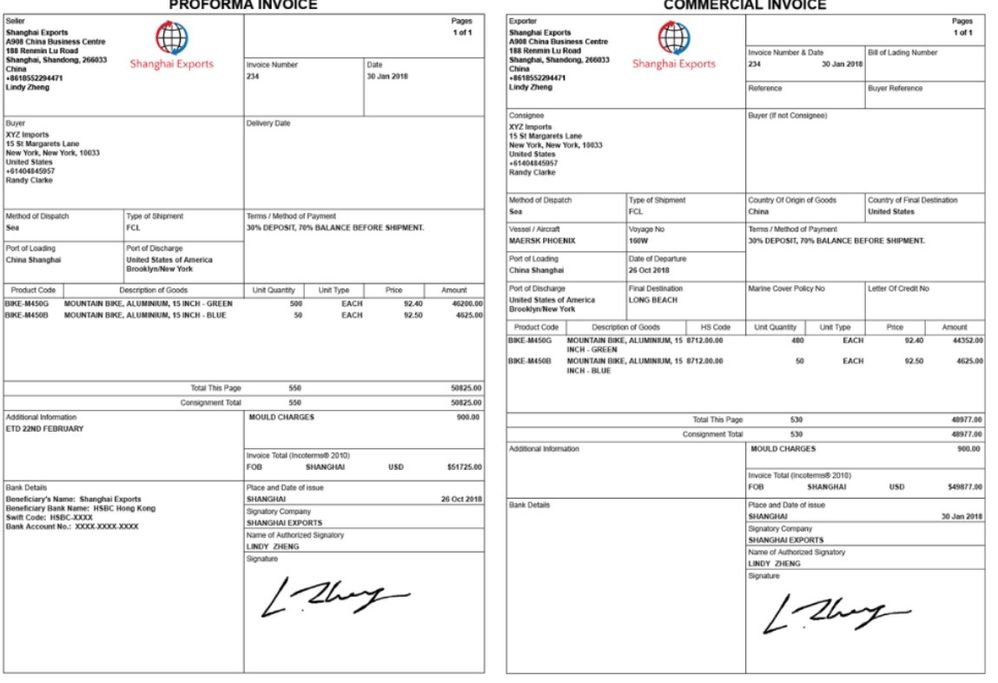

A proforma invoice is basically a preliminary bill of sale sent to buyers in advance of the delivery of goods. It will usually contain details like a description of the items being sold, their price, and the total amount payable along with any taxes and fees incurred. This gives the customer as precise an estimate as possible of the expected cost of an order. Talking about the difference between a proforma invoice and a standard commercial invoice is that, it is preliminary or provisional. This means that the details are subject to change. It further doesn’t need any invoice number and should be clearly labeled with the term proforma.

What is the purpose of a proforma invoice?

Talking about the usefulness of a proforma invoice is basically a useful addition to a business’s sales process. It gives an estimate of the cost of a sale and further reduces the likelihood that they are exposed to any unanticipated charges, reducing the risk of payment disputes when commercial invoices are issued. A few use cases of Proforma Invoice:

- When declaring the value of goods to customs when exporting to foreign countries.

- Another use case can be when you don’t have all the details to issue a commercial invoice

- Or when you need something to act as a formal payment request when a recipient wishes to pay in advance.

What is the difference between an invoice and a proforma invoice?

There are several key differences between a standard commercial invoice and a proforma invoice. Let us have a look:

| Key Difference | Commercial Invoice | Proforma Invoice |

| Time of issue | Issued to customers after goods or services have been received. | Issued to customers before an order has been placed |

| Objective | In order to inform the buyer of the amount due and how to make payment. | To help customers decide whether or not to place an order. |

| Details included | An invoice number, contact information, issue date, amount payable, means of payment, billing address, and terms & conditions. | Contact details, date of issue, a description of the goods and services, and the amount due. It needs an invoice number and should be clearly labeled as proforma. |

| Accounting | A commercial invoice should be recorded as accounts payable and filed for reference. | Proforma invoices are not used for accounting purposes. |

Did you know: How to Fix Script Error When Accessing QuickBooks Desktop?

What is the difference between a proforma invoice and a quote?

Proforma invoice has more in common with a quote than a commercial invoice. Quotes and proforma invoices are both used at the same time in the sales process and further provide the customer with information about the transaction. The two main differences include:

- A quote basically provides information about what a customer can expect from a transaction before it has been agreed upon.

- Whereas, a proforma invoice provides full and final details after the customer has committed to a transaction.

When should you send a proforma invoice?

A proforma invoice is basically sent before a sale is completed. There are two main reasons behind this:

- Cost estimate – Proforma invoices basically provide customers with a breakdown of the items they have requested and provide an accurate indication of the total amount due. It is not a payment request and can still be adjusted if the goods and services you provide are being negotiated.

- International shipping – These invoices are commonly used by export companies and further include details about shipping, packaging, weight, and delivery fees. Moreover, they provide a clear declaration of the value of items so that they can quickly pass through customs.

Is a proforma invoice legally binding?

Even though a proforma invoice is a crucial business document, it is not legally binding. It provides a price estimate for a business’s product or service. However, it is not a legal record of sale and thus, it cannot be used as evidence for a completed transaction.

What should a proforma invoice look like?

A proforma invoice usually includes the following details:

- Date of issue

- Contact details

- A description of the goods and services you provide

- The price of goods and services you provide

- Sales tax and any other taxes or fees that apply

- Applicable shipping costs

- Total Amount due

Different types of Proforma invoice

QuickBooks offers you with a bunch of proforma invoices, which include the following:

- For shipping – This type of invoice is a type of business invoice. However, such invoices do not have any details about VATs and taxes. Note that, both sides can access it to analyze the real cost of the products and services.

- For customers – Such an invoice works as a written authentication to the customer end from the seller end which guarantees the delivery of the product. It further comprises the complete description of the payment that assists both sides in monitoring the payment.

What are the essential points to consider before preparing a proforma invoice?

There are three crucial points that you need to consider when preparing a proforma invoice:

- Proforma invoices are basically saved as accounts receivable. It simply means you can prepare it to monitor the payments that you are going to acquire.

- A Proforma invoice is used as a substitute for a particular invoice. It should be noted as assumed as the original invoice and also the customer should not make any payment depending on it.

- Another important point to note is that this type of invoice and QuickBooks payroll are not the same. Thus, as a seller, you do not need to make any payment to the client.

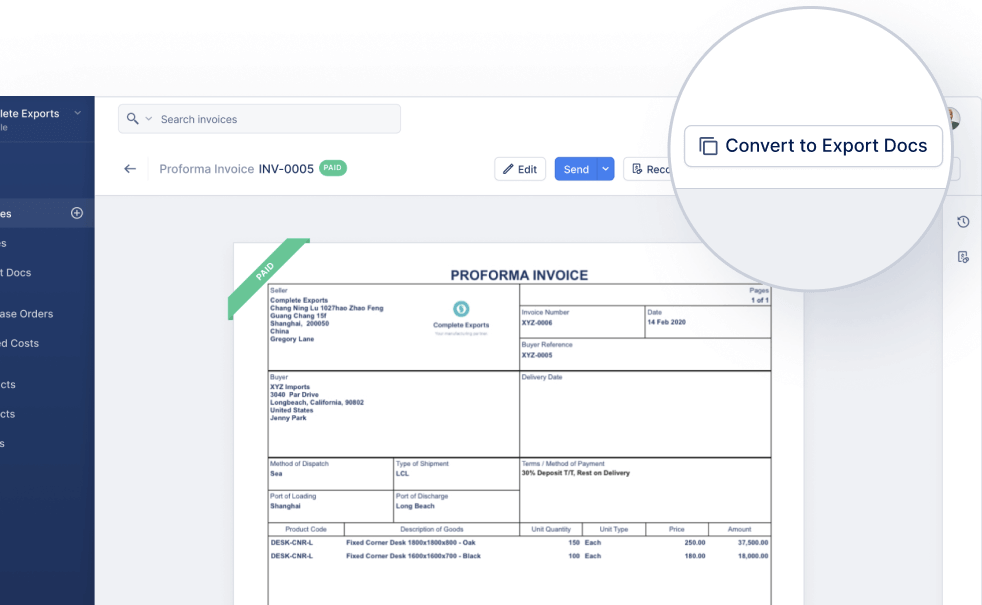

How to create a proforma invoice in QuickBooks?

In order to create a proforma invoice in QuickBooks, you need to perform the following steps:

- Click on the gear icon on the right side of the screen.

- After that, a window will open where you will be required to search for a custom-form style and then select a new option.

- Now, press on the new style drop-down menu and then you will have to choose the estimate tab.

- Once done with that, press the content tab.

- You now have to click on the edit tab and also select the make default option.

- Then, you will see an option to edit the name of the estimate. In case you wish to, you can alter or keep it as it is.

- Save the change and exit the screen.

Steps to add a logo to a proforma invoice

You need to perform a few steps to add a logo to a proforma invoice.

For Application

- You need to initially click on the settings tab and also select the work info option

- After that, click on the edit option and also select the image and upload it in the logo option.

- The last step is to click on save the settings.

For Website

- You need to head to the invoice section and also press the option to change the invoice.

- Once done with that, press the option to edit information.

- And lastly, upload the image and save it.

Also Read: How to Delete Duplicate Transactions in QuickBooks?

How to repair payment if they are assisted with the incorrect invoice?

You can try to change the payment that has been applied by you on a particular invoice. The steps involved in here are:

- You need to click on create and then head to the other option and choose journal entry.

- After that, enter the details like the amount acquired, customer details, and the amount to be paid.

- The last step is to enter the same details again, avoid adding the customer name and then save it.

Steps to duplicate a proforma invoice in QuickBooks

For a bunch of reasons, you might have to duplicate a specific proforma invoice in QuickBooks. You can select the clients you wish to send the proforma invoice to. The window for multiple invoices will open and you will be able to review and make changes to clients’ Proforma invoices. You will then have to save changes.

- Firstly, choose customers to whom you wish to send the Proforma invoice.

- After that, click on the next tab.

- Now, on the screen for multiple invoices, you will be able to witness the invoice for all the customers.

- It is possible to add and edit the invoices.

- Ensure that the invoices have been saved.

It should be noted that a proforma invoice that you choose to replicate will have duplicate lines. In case you have not set any choices regarding taxes or terms that are special to a customer, then it is not mandatory to create several proforma invoices.

Also Read: QuickBooks Runtime Redistributable in QuickBooks Desktop

Conclusion!

Toward the end of this segment, we believe that the information enumerated above is enough to let you understand what a proforma invoice is all about. However, in case you have any queries that remain unanswered, then do not hesitate to connect with our technical support team at +1-866-453-7060, and let our certified QuickBooks ProAdvisors help you with the queries immediately.

Other Related Articles:

How to Tackle QuickBooks Abort Error?

QuickBooks Remote Access from Another Computer

How to Fix Error: Could not connect to the email server problem?