Get Seamless QuickBooks Payroll Support

- Instant and secure technical support

- Upgrade and update your software with us

- Result oriented service and customer centric approach

Execute payroll operations smoothly with QuickBooks Payroll

Primarily invented by Intuit Inc. QuickBooks Payroll is one of the finest accounting software that assists the entrepreneurs to carry out their payroll activities with much ease. There are three versions of QuickBooks Payroll- Basic version, Enhanced version, and assisted version. QuickBooks offers an extensive support to entrepreneurs in cutting the cost that might be incurred in keeping the accounting record files. In a nutshell, QuickBooks payroll can work wonders for the businesses, if used wisely.

When to seek for QuickBooks payroll support?

If you have any of the queries associated with QuickBooks payroll, you can seek for professional assistance. With our QuickBooks payroll support, you will get answers to queries such as:

- How can I fix QuickBooks payroll error 30159?

- What can I do to rectify update error 12XXX while getting the updates?

- How can I request a direct deposit limit increase?

- What is the procedure to change forgotten PIN for processing direct deposit payroll for basic, standard, or enhanced payroll.

And the list of questions continues……!! With our team, you can get answers to all your QuickBooks payroll associated queries.

Why to choose QuickBooks Payroll Customer Service?

Immediately troubleshoot the issues for QuickBooks payroll Basic, Standard, & Enhanced Payroll

Payroll Software & Services for Small Business

You can obtain success around the globe with greater time demands and leaner profit margins. There is an alternate way to do business, by outsourcing non-core functions like Payroll. Payroll Management has been serving the payroll needs since many decades ago or since 1989. It doesn’t matter you are a one-person company or you have several hundred, time is valuable. Management of Payroll guarantees you that your time will save by providing timely preparation of your W-2’s at the end of the year and by eliminating time spent balancing and cross-checking for errors.

Most of the business owners, accountants, bookkeepers, and CPA’s use the Intuit QuickBooks Payroll services for the exact tax and payroll calculation. This software ensures that every employee in the organization attains exact figures, insurances, and allowances. But woefully, sometimes the QuickBooks Payroll users encounter critical errors while handling it. You can either sort out Payroll error by contacting Intuit or get in touch with our payroll customer service team.

It’s so unfortunate that you will hardly find any way to contact any Intuit support executive or agent directly. In such a circumstance, you can refer to the Intuit Payroll Support Page to know the answer or raise a query. But definitely, it’s not the best way out to receive immediate support.!

We, at Pro Accountant Advisor take care of your entire queries and problems related to QuickBooks Payroll. With us, you will always enjoy the best experience as our team contains certified accountants, CPA’s, and ProAdvisors who are highly efficient at their work.

How To Get Started With Payroll In QuickBooks ( Easy Tutorial)

Payroll Software & Services for Small Business

You can obtain success around the globe with greater time demands and leaner profit margins. There is an alternate way to do business, by outsourcing non-core functions like Payroll. Payroll Management has been serving the payroll needs since many decades ago or since 1989. It doesn’t matter you are a one-person company or you have several hundred, time is valuable. Management of Payroll guarantees you that your time will save by providing timely preparation of your W-2’s at the end of the year and by eliminating time spent balancing and cross-checking for errors.

Most of the business owners, accountants, bookkeepers, and CPA’s use the Intuit QuickBooks Payroll services for the exact tax and payroll calculation. This software ensures that every employee in the organization attains exact figures, insurances, and allowances. But woefully, sometimes the QuickBooks Payroll users encounter critical errors while handling it. You can either sort out Payroll error by contacting Intuit or get in touch with our payroll customer service team.

It’s so unfortunate that you will hardly find any way to contact any Intuit support executive or agent directly. In such a circumstance, you can refer to the Intuit Payroll Support Page to know the answer or raise a query. But definitely, it’s not the best way out to receive immediate support.!

We, at Pro Accountant Advisor take care of your entire queries and problems related to QuickBooks Payroll. With us, you will always enjoy the best experience as our team contains certified accountants, CPA’s, and ProAdvisors who are highly efficient at their work.

When you Suppose to Dial the QuickBooks Payroll Technical Support Number?

There are dozens of QuickBooks Payroll issues that a QuickBooks user encounters. Here are some of the FAQ’s associated with QuickBooks Payroll. However, you can resolve the QuickBooks payroll related issues or errors – you can seek QuickBooks Payroll Support Service or QuickBooks Certified ProAdvisors at +1-888-510-9198. Dial the toll-free QuickBooks Online customer support service number that is available round the clock.

QuickBooks Payroll Errors

To Resolve the QuickBooks Payroll Update Error 12xxx Series?

To Edit or Delete QuickBooks Payroll checks

To Setup, Edit and Remove Direct Deposits for Employees

To Setup, Edit and Remove Direct Deposits for Employees

To create bonus or termination payroll checks for QuickBooks Payroll

To print pay stubs while using QuickBooks Payroll

To Fix QuickBooks Payroll Unrecoverable Error 00000 XXXXX

“Error: QuickBooks Payroll Setup – Error Code: XXXXX XXXXX” or “Unrecoverable Error: Error Code: XXXXX XXXXX”. Hire our ProAdvisors for the better QuickBooks technical support.

To Create Time-Sheets and Time Data Report

This will help you to enter the employees’ rime data & working hours. It will further assist you in creating the employees’ paychecks. For any help, you can contact us at +1-888-510-9198.

To transform direct deposit primary principal

To Troubleshoot the QuickBooks Payroll error 30159 While Updating

The QuickBooks Payroll Error Code 30159 appears while deactivating the EIN on the computer. If you want to reactivate it; you suppose to dial the toll-free support number of QuickBooks service at +1-888-510-9198.

To process payroll or payroll forms in an Accountant’s Copy

Compelling Features of QuickBooks PayrollCompelling Features of QuickBooks Payroll

Create Paychecks

No Tax Penalty Surety

E-filling & E-Pay

Payroll Updates

State Forms

Direct Deposit

After the Fact Payroll

View My Paycheck

View My Paycheck is another marvelous feature that possesses by the QuickBooks Payroll. It’s a kind of application which employees can access with a unique ID & password checkout the details of their paychecks.

Federal Forms

Avail QuickBooks Payroll Customer Service

Features & Benefits You Get

- Cash flow control and risk management.

- Payroll Services are accessible in global anytime.

- Setting up your payroll software into desktop without any hassle.

- Immaculate Services proffered by Certified Professionals.

- Elimination of employer liability.

- Speedy, accurate and timely processing.

- Complete secure and confidential

- Prompt and accurate electronic tax liability filing

- Access to a rich seam of information

- Constantly track payroll costs and employee working and other information

- Tracking and maintaining records of bank and credit card transactions

- Accuracy of paychecks and payroll

Avail QuickBooks Payroll Customer Service

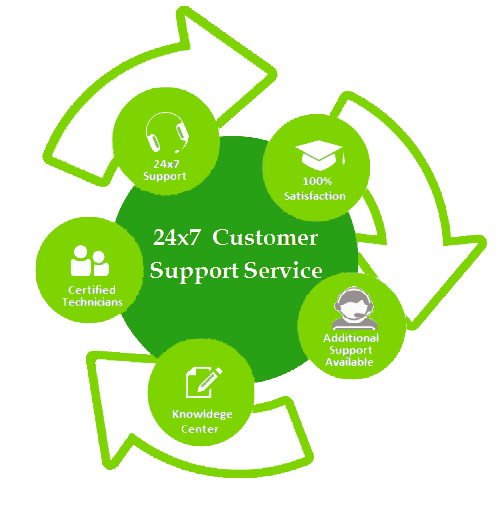

Why to choose us?

You can get in touch with us anytime anywhere by making a call on our toll-free Intuit Payroll Support Number. But it’s important to know what makes us different from others?? Apart from the Intuit itself, thousands of companies are providing support service for QuickBooks Payroll. Because of the increasing demand & popularity of QuickBooks, it becomes quite difficult to manage all the QuickBooks Payroll issues alone. Hence, the third-party technical support services are available at affordable prices.

In order to know how our QuickBooks Payroll Services differ from others, see our features below:-

- Immediate, efficient, trustworthy, and safe customer service.

- Experienced, knowledgeable & certified team of ProAdvisors.

- Outcome oriented help service that too at reasonable price.

- Anytime customer care service with 100% satisfaction.

Our certified Intuit QuickBooks ProAdvisors endows the best quality QB technical support and help for Intuit Payroll. Facing data integration error, file taxes and paychecks errors, direct deposit issue

Sync Payroll Data Integration & Intuit QuickBooks

Intuit has synced the Payroll with QuickBooks software. This simply indicates that now you can import the Payroll associated data to QuickBooks software. This helps the QB users in term of accepting or making business payments, managing the account, and access to QB company files. These all features assist you to save both time & effort for all essential works. Our committed technicians & consultants are always there to deliver the premium customer service to all the QuickBooks users. We are enough capable & qualified to sort out any QuickBooks issue instantaneously.

Support & Help for Payroll Tax Calculation

Troubleshoot QuickBooks Payroll Update Error

QuickBooks Desktop Assisted Payroll

List of Few Common Payroll Errors in QuickBooks

Although QuickBooks gratify you with numerous advantageous features but it does withhold some technical hiccups. ProAdvisors furnish 24×7 support for the issues associated with the QuickBooks Payroll. Some of the QuickBooks Payroll errors are enlists below:-

How can our QuickBooks Payroll support team help you?

If you want anytime and anywhere support, then you have landed on the right destination. What makes us stand out in the ocean of third party service providers is our 24*7 seamless support, quality assurance, complete support at affordable rates, guaranteed rectification of all your QuickBooks payroll associated errors, finest resolution rate in the industry, and a lot more.

We own an exceptional team of certified QuickBooks ProAdvisors and they do not leave any stone unturned to provide the finest possible services all across the globe. We don’t settle anything less than perfect. Our services revolve around our clients, as we follow customer centric approach. Just dial our Payroll support number +1-888-510-9198 and experience our flawless services.

Hopefully, it may help you and yet troubling somewhere or technical faults is out of the mind for how to fix such errors timely. Then connect us and seek appropriate results promptly. If facing any issue or have any queries then feel hesitate free in asking your question or doubts at our QuickBooks Support Number. Help is available 24/7 for any QuickBooks Error. Contact us today and find out how easy it can be!